leui.site

Market

How To Bring Up My Credit Score

You can “fix” a bad credit score by paying bills on time, keeping credit card balances low and adding positive payment history to your credit report with a. How to improve your credit scores · Make on-time payments every month. You can set up automatic payments or electronic reminders to help you remember due dates. 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once · 4. Get credit for paying monthly utility and. Pay off delinquent bills. Paying down delinquent accounts won't remove missed payments from your report. But it can make you look better to creditors. Look for. The higher your score, the better your chances. Borrowers with scores above have a better chance at qualifying for credit cards and loans and getting the. Pay down credit card balances. Your score starts to suffer when your balance exceeds 30% of your credit limit. With 10% or less, you'll get the. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. 5 ways to improve your credit score · Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on new. 1. Pay your bills on time. · 2. Keep your balances and overall credit card debt low. · 3. Be cautious about new credit applications. · 4. Use a combination of. You can “fix” a bad credit score by paying bills on time, keeping credit card balances low and adding positive payment history to your credit report with a. How to improve your credit scores · Make on-time payments every month. You can set up automatic payments or electronic reminders to help you remember due dates. 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once · 4. Get credit for paying monthly utility and. Pay off delinquent bills. Paying down delinquent accounts won't remove missed payments from your report. But it can make you look better to creditors. Look for. The higher your score, the better your chances. Borrowers with scores above have a better chance at qualifying for credit cards and loans and getting the. Pay down credit card balances. Your score starts to suffer when your balance exceeds 30% of your credit limit. With 10% or less, you'll get the. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. 5 ways to improve your credit score · Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on new. 1. Pay your bills on time. · 2. Keep your balances and overall credit card debt low. · 3. Be cautious about new credit applications. · 4. Use a combination of.

Tips for increasing credit score more quickly · Get a copy of your credit report and remove errors · Pay down credit card balances to under 30 percent · Activate. Create a plan · Contact all creditors. · Pay off delinquent accounts first, then debts with higher interest rates; you may save money · Consider a debt. Making on-time payments is one of the largest factors in determining credit scores. The more you pay bills on time, the higher your score will likely be. Keep. Dispute any errors that you find. This is the closest you can get to a quick credit fix. A Consumer Reports study found that 34% of consumers have at least one. Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. · Pad out a thin credit. How to Increase Credit Score · 1. Pay Your Bills on Time · 2. Don't Close Old Accounts · 3. Monitor Credit for Errors · 4. Limit Credit Applications · 5. Work. You're entitled to a free copy of your credit reports every 12 months from each of the three nationwide credit bureaus by visiting leui.site One of the easiest ways to improve your credit score is by paying your bills on time every month. This will start to eliminate your credit card debt. Your. All you gotta do to join the Club is pay every bill, every month on time and be ultra, ultra conservative about using a credit card for spending. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. Have a trusted family member or friend add you as an authorized user. DO NOT ask for a card or anything. JUST them adding you will bring you up. Here are four such options designed for consumers without credit—or those with a low credit score—which can help boost your credit rating at no cost to you. 10 Ways to Improve Your Credit Score · 1. Pay your bills when they're due. · 2. Keep credit card balances low. · 3. Check for errors. · 4. Make a plan to pay down. Trying to raise your credit score? · Keep track of your progress. · Always pay bills on time. · Keep credit balances low. · Pay your credit cards more than once a. How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-. Many credit-scoring models consider the number and type of credit accounts you have. A mix of installment loans and credit cards may improve your score. However. You are allowed to use a primary cardmember's credit card and, if payments are made on time and in full, this can help build your score. That's because payment. If your creditworthiness has taken a ding, these fixes should spruce it up · 1. Check your credit report at least once a year · 2. Set up automatic bill payment. 2) Optimize Your Credit Utilization Ratio · Pay your cards off times per month instead of once per month to keep your balance low at any one time. · If your.

How To Not Pay Pmi When Buying A House

Learning how to avoid private mortgage insurance is an excellent way for home buyers to reduce the costs of their mortgage loan. Paying for private mortgage insurance is just about the closest you can get to throwing money away. This is a premium designed to protect the lender of the home. How to Avoid Paying PMI · Make a down payment of 20% or more. · Apply for a VA loan (if eligible). A VA loan however only avoids the monthly mortgage insurance. Lenders are generally willing to accept a lower down payment (than the standard 20%) if the lender obtains mortgage insurance. You can not only get the home you. 5 ways to save money and avoid paying PMI · 1. Shop around for a loan that doesn't require PMI · 2. Check out state and local homebuyer assistance programs · 3. A major consideration with FHA financing is the PMI does not go away if you put less than 10% down. The PMI will stay with the loan for the entire term. If you. At what point can I remove the Private Mortgage Insurance (PMI) from my loan? · The loan has not been more than 60+ days past due in mortgage payments within the. This is exactly what it sounds like – a mortgage loan that doesn't require PMI, even if you don't have a 20% down payment. These are offered at the discretion. Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment. If you're current on your mortgage. Learning how to avoid private mortgage insurance is an excellent way for home buyers to reduce the costs of their mortgage loan. Paying for private mortgage insurance is just about the closest you can get to throwing money away. This is a premium designed to protect the lender of the home. How to Avoid Paying PMI · Make a down payment of 20% or more. · Apply for a VA loan (if eligible). A VA loan however only avoids the monthly mortgage insurance. Lenders are generally willing to accept a lower down payment (than the standard 20%) if the lender obtains mortgage insurance. You can not only get the home you. 5 ways to save money and avoid paying PMI · 1. Shop around for a loan that doesn't require PMI · 2. Check out state and local homebuyer assistance programs · 3. A major consideration with FHA financing is the PMI does not go away if you put less than 10% down. The PMI will stay with the loan for the entire term. If you. At what point can I remove the Private Mortgage Insurance (PMI) from my loan? · The loan has not been more than 60+ days past due in mortgage payments within the. This is exactly what it sounds like – a mortgage loan that doesn't require PMI, even if you don't have a 20% down payment. These are offered at the discretion. Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment. If you're current on your mortgage.

The best way to avoid PMI is to make a down payment of at least 20% of the home's purchase price. If you don't have a big down payment, ask your lender about. There are many other types of mortgages that don't require PMI. For example, Navy Federal Credit Union offers members certain mortgages that have no PMI. A PMI Primer. More than half of homeowners with PMI are first-time homebuyers who did not have the 20 percent down payment banks require for a conventional loan. Some credit unions and banks will do "professional loans" for people like doctors or lawyers and there can be a lot less down payment and no PMI. Avoiding private mortgage insurance (PMI) is possible. One way to avoid paying this extra fee is anticipating your home value's appreciation. How to Avoid Paying PMI · Make a down payment of 20% or more. · Apply for a VA loan (if eligible). A VA loan however only avoids the monthly mortgage insurance. Private mortgage insurance (PMI) protects the lender if you default on your mortgage payments, and your house isn't worth enough to entirely repay the. In order to avoid having to add PMI (private mortgage insurance) to a loan you need to pay a down payment of at least 20% or more. Actually you. Hunt for lender-paid mortgage insurance or a piggyback loan, or seek gifts or other assistance to fatten the down payment. SoFi offers fixed-rate conventional. While a down payment of at least 20% can help you avoid private mortgage insurance, there are alternative options available, such as lender-paid mortgage. Three options exist for buyers who want to avoid PMI premiums but still put down less than 20%: compel the lender to pay: In exchange for a higher interest rate. Another option is to refinance into a new conventional loan. If you have at least 20% in home equity, you can avoid PMI payments on the new loan; just be sure. Generally, PMI can be removed from your monthly payments in two ways: when you pay your loan balance down below 80% of the purchase price of your home, or once. Another option for not paying PMI is to find a mortgage that doesn't require it at all. PrimeLending is proud to be a lender that offers no PMI mortgage options. You may not be able to remove PMI by refinancing unless you have at least 20% equity in your home. The rules for removal of MIP are different for FHA loans and. It protects them in case you default on payments. You probably had to add private mortgage insurance (PMI) to your conventional loan if you bought a home with. Ways to Avoid PMI · New 1% Down Conventional Loan · Put Down 20% · Get a 2nd Lien · Pay an Upfront Fee (Borrower Paid PMI) · Lender Paid PMI · Veterans Only Loan · Buy. But the benefit to buyers is that they can buy homes with less money up front. Once you start making your monthly mortgage payments, you're building equity and. Another option for not paying PMI is to find a mortgage that doesn't require it at all. PrimeLending is proud to be a lender that offers no PMI mortgage options. Combined with paying down your loan, you could potentially have the 20% equity you need to refinance your loan without the need for PMI. This could save you.

Best Interest Rate For Va Home Loan

Main pillars of the VA home loan benefit · No downpayment required · Competitively low interest rates · Limited closing costs · No need for Private Mortgage. As of September 14, , the rates in Utah are % (% APR) for a year VA mortgage and % (% APR) for a year VA loan. 30 Yr Fixed VA. In practice, there's no cap. According to the polling data at Mortgage News Daily, the average 30YR Fixed VA loan is at % today. Today's current VA home loan mortgage rates* ; VA loans, %, %. These low-cost home loans offer several advantages for buying or refinancing a home, and it is usually much easier to get approved compared to conventional. Compare the best VA mortgage rates for your home purchase or refinance and you could save thousands over the life of your loan. Currently, Quicken Loans offers year, year, and year fixed VA loans with VA home loan rates of %, % and %, respectively. The APR for For instance, year fixed VA rates currently have interest rates hovering somewhere around %–% and annual percentage rates (APRs) between %–%. INTEREST RATES. The interest rate on VA loans can be negotiated based on prevailing rates in the mortgage market. Once a loan is made, the interest rate set. Main pillars of the VA home loan benefit · No downpayment required · Competitively low interest rates · Limited closing costs · No need for Private Mortgage. As of September 14, , the rates in Utah are % (% APR) for a year VA mortgage and % (% APR) for a year VA loan. 30 Yr Fixed VA. In practice, there's no cap. According to the polling data at Mortgage News Daily, the average 30YR Fixed VA loan is at % today. Today's current VA home loan mortgage rates* ; VA loans, %, %. These low-cost home loans offer several advantages for buying or refinancing a home, and it is usually much easier to get approved compared to conventional. Compare the best VA mortgage rates for your home purchase or refinance and you could save thousands over the life of your loan. Currently, Quicken Loans offers year, year, and year fixed VA loans with VA home loan rates of %, % and %, respectively. The APR for For instance, year fixed VA rates currently have interest rates hovering somewhere around %–% and annual percentage rates (APRs) between %–%. INTEREST RATES. The interest rate on VA loans can be negotiated based on prevailing rates in the mortgage market. Once a loan is made, the interest rate set.

VA Mortgage Rates ; %, , % ; Rates as of Sep 15, ET.

VA Mortgage Rates · year Fixed-Rate VA Loan: An interest rate of % (% APR) is for a cost of Point(s) ($5,) paid at closing. · year. We offer % financing 66 on our VA Home Loans to eligible buyers. In comparison, FHA loans come with a % down payment requirement. Units: Percent, Not Seasonally Adjusted. Frequency: Daily. Notes: This index includes rate locks from U.S. Department of Veterans Affairs loans. Discover the benefits of a VA loan and VA mortgage rate information from USAA Top VA Home Loan LenderSee note7. USAA Bank is ranked one of the top VA. Today's VA Loan Rates: Year Fixed VA Purchase Loan. %, % APR. Points: ($). Year Fixed VA Purchase Loan. %, % APR. The VA home loan interest rate is usually equal to or lower than the interest rate for a conventional mortgage. back to top. When Is The Best Time To Lock In. A PenFed VA Loan is recognized by Money Magazine as “Best for Competitive Rates,” saving you more! This government-backed loan requires little to no down. Current VA mortgage rates for September 15, ; year fixed VA, %, %, + Current VA mortgage and refinance rates ; VA year 5/1 ARM mortgage purchase. %. % ; year fixed rate VA refinance. %. % ; year fixed rate. Here are today's VA purchase loan rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. Interest rates as low as %* · % APR* · Get Started · Resources. Today's VA Home Loan Rates ; %, %, % ; %, %, % ; %, %, % ; %, %, %. The current national average 5-year ARM VA mortgage rate is up 5 basis points from % to %. Last updated: Sunday, September 15, See legal. The rate on a 5-year adjustable rate mortgage (ARM) VA mortgage was %. Note: Above mentioned VA home loan interest rates in the United States are subject to. VA Mortgage Rates · year Fixed-Rate VA Loan: An interest rate of % (% APR) is for a cost of Point(s) ($5,) paid at closing. · year. It is in your best interest to seek expert advice BEFORE you legally • To refinance an existing VA loan to obtain a lower interest rate. Use of. Answer a few simple questions in our interactive video to see what type of home loan works best for you. interest rate on your loan, you must meet all of the. Get The Lowest VA Home Loan Interest Rate · The ranges of interest rates for this week are between % and %. · To inquire about the lowest rate for today. Compare the best VA mortgage rates for your home purchase or refinance and you could save thousands over the life of your loan. Lenders offer different loan interest rates and fees, so shop around for the loan that best meets your needs. 4. Choose a real estate agent – Meet with several.

Best Cooling Window Air Conditioner

LG window air conditioners allow you to cool your space quietly, efficiently, and beautifully. Our innovative units were designed to fit unobtrusively inside. Get Gradient, a modern and energy efficient window AC that cools, heats, and never blocks the view. Smarter and quieter, without taking up window space. Window Air Conditioners · GE · LG · Frigidaire · Windmill · GE Profile · Whirlpool · Amana · Keystone; Show More. Features. Cool Only Air. Sort by:Best Sellers. Best Match / Relevancy; Price Friedrich Smart Chill® Premier Series BTU Volt Window Cooling Air Conditioner. Best Buy customers often prefer the following products when searching for thin window air conditioner. ; GE - Sq. Ft. 5, BTU Window Air Conditioner with. Position the AC unit on an elevated surface: Elevating your air conditioning unit slightly off the ground can significantly improve its cooling distribution. Top Rated Window Air Conditioners · GE. sq ft Window Air Conditioner (Volt, BTU) · LG. sq ft Window Air Conditioner (Volt, BTU) · GE. Window Air Conditioners. Sort by. Sort by. Featured, Best selling, Alphabetically Summer's hottest days are no match for the cooling relief of this 14, BTU. Overall, the GE Profile AHTT08BC impressed us with its performance and value. For less than $, you can have a unit that consistently cools a medium-size. LG window air conditioners allow you to cool your space quietly, efficiently, and beautifully. Our innovative units were designed to fit unobtrusively inside. Get Gradient, a modern and energy efficient window AC that cools, heats, and never blocks the view. Smarter and quieter, without taking up window space. Window Air Conditioners · GE · LG · Frigidaire · Windmill · GE Profile · Whirlpool · Amana · Keystone; Show More. Features. Cool Only Air. Sort by:Best Sellers. Best Match / Relevancy; Price Friedrich Smart Chill® Premier Series BTU Volt Window Cooling Air Conditioner. Best Buy customers often prefer the following products when searching for thin window air conditioner. ; GE - Sq. Ft. 5, BTU Window Air Conditioner with. Position the AC unit on an elevated surface: Elevating your air conditioning unit slightly off the ground can significantly improve its cooling distribution. Top Rated Window Air Conditioners · GE. sq ft Window Air Conditioner (Volt, BTU) · LG. sq ft Window Air Conditioner (Volt, BTU) · GE. Window Air Conditioners. Sort by. Sort by. Featured, Best selling, Alphabetically Summer's hottest days are no match for the cooling relief of this 14, BTU. Overall, the GE Profile AHTT08BC impressed us with its performance and value. For less than $, you can have a unit that consistently cools a medium-size.

Discover Window Air Conditioners on leui.site at a great price. Our Air Conditioners & Accessories category offers a great selection of Window Air. A BTU Window Air Conditioner is an ideal power level for small rooms and small bedrooms. If you're looking to cool a space measuring. Shop Window air conditioners and stay cool with Energy Star window AC units from top brands like GE. Easy to install and cost-effective. Best seller. BLACK+DECKER 8,BTU 4-Speed ENERGY STAR Electronic Window Air Cool Window Air Conditioner, White, LWHRSM. out of 5 Stars. Window Air Conditioners · GE - Sq. Ft. BTU Smart Window Air Conditioner - White · GE - Sq. Ft. BTU Smart Window Air. Choosing the right window air conditioning unit for your room will help keep you cool and save energy when the weather heats up. Here are three important. Keep your home at a cool and comfortable temperature on the warmest days with a window air conditioner by GE Appliances. From small, whisper quiet units to. The top-selling product within Window Air Conditioners is the LG Electronics 12, BTU /Volt Window Air Conditioner LWHRSM Cools Sq. Ft. with. Black & Decker BD06WT6 BTU Window Air Conditioner Unit, AC Cools Up to Square Feet, Energy Efficient, White New! Hisense 10, BTU Smart Window Air. Position the AC unit on an elevated surface: Elevating your air conditioning unit slightly off the ground can significantly improve its cooling distribution. Two moderately priced good quality brands are Frigidaire and LG. No unit is trouble free. You're unit wouldn't cool the room when it was above. In addition, window air conditioners are often more efficient than portable air conditioners allowing them to cool a larger space at a lower cost. Cons of. The Midea U is the "Best Window AC" on the market. The Midea U has been awarded the "Best AC" on the market by The Wirecutter, The Wall Street Journal, Good. Alternatives to Window Air Conditioners for Energy Efficiency and Lower Bills · Ductless mini splits are a great alternative to window AC units, especially in. Ace offers window air conditioners to cool your home efficiently. Shop air conditioner filters and accessories online for easy maintenance. A window air conditioner, also known as an A/C, conveniently cools a single room. It can be an easy-to-install alternative to a central air conditioning system. Why Buy a Window Air Conditioner? It's a good question: there are a lot of ways to cool off, from simple fans to central air units and even. You have two main choices: window units and ductless AC. Both can cool at least one room, neither require ducts, but which is the best option? Window air conditioners with heater models provide targeted cooling and heating for indoor comfort year-round. Designed to cover small- to large-sized spaces. Black & Decker BD06WT6 BTU Window Air Conditioner Unit, AC Cools Up to Square Feet, Energy Efficient, White New! Hisense 10, BTU Smart Window Air.

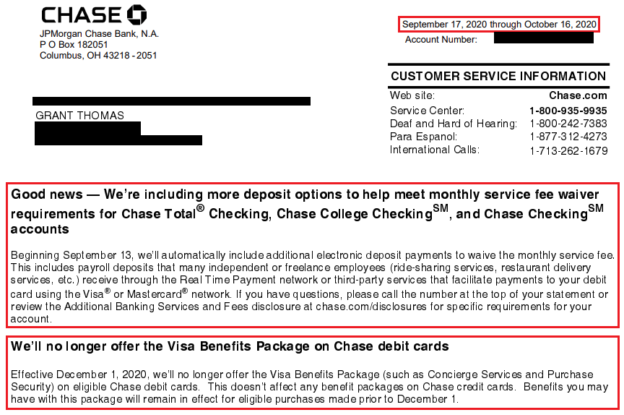

Chase Checking Account Monthly Service Fee

Account details include: $25 Monthly Service Fee OR $0 with one of the following each monthly statement period: An average beginning day balance of $15, Chase Bank charges a $12 monthly fee on Chase Total Checking accounts. You can avoid the fee on your Chase Total Checking account if any one of. Service Fee: Chase Total Checking has no Monthly Service Fee when you do at least one of the following each statement period: Option #1: Have electronic. $12 monthly service fee; No Monthly Service Fee while in school up to the graduation date provided at account opening (five years maximum) for students For with transaction and complex needs, Chase Performance Business Checking account good. To avoid the $30 monthly service fee, a combined daily balance of. On March 17, , the Monthly Service Fee will increase to $12 (up from $6). You can avoid this fee by doing ONE of the following each. Service Fee: Chase Secure Checking has no Monthly Service Fee when you have electronic deposits made into this account totaling $ or more, such as payments. Chase Bank charges a $25 monthly fee on Chase Sapphire Checking accounts. You can avoid the fee if: Average beginning day balance of at least $75, in this. $12 or $0 Monthly Service Fee How to avoid the feeOpens Overlay. Direct Deposits made into this account totaling $ or more. Account details include: $25 Monthly Service Fee OR $0 with one of the following each monthly statement period: An average beginning day balance of $15, Chase Bank charges a $12 monthly fee on Chase Total Checking accounts. You can avoid the fee on your Chase Total Checking account if any one of. Service Fee: Chase Total Checking has no Monthly Service Fee when you do at least one of the following each statement period: Option #1: Have electronic. $12 monthly service fee; No Monthly Service Fee while in school up to the graduation date provided at account opening (five years maximum) for students For with transaction and complex needs, Chase Performance Business Checking account good. To avoid the $30 monthly service fee, a combined daily balance of. On March 17, , the Monthly Service Fee will increase to $12 (up from $6). You can avoid this fee by doing ONE of the following each. Service Fee: Chase Secure Checking has no Monthly Service Fee when you have electronic deposits made into this account totaling $ or more, such as payments. Chase Bank charges a $25 monthly fee on Chase Sapphire Checking accounts. You can avoid the fee if: Average beginning day balance of at least $75, in this. $12 or $0 Monthly Service Fee How to avoid the feeOpens Overlay. Direct Deposits made into this account totaling $ or more.

Chase Secure Checking · Spend only the money you have available, without worrying about overdraft fees. Footnote(Opens Overlay) · There is a $ Monthly Service. If you have more than $ in direct deposit monthly, a balance of $1, or more daily or an average balance of $5, or more, the monthly maintenance fee is. Chase Total Checking · $25 monthly service fee, which is waived if your Chase accounts have a combined average daily balance of at least $75, · Earns small. Chase College Checking℠ is a good option for students looking for fee-free checking. The account has no minimum deposit requirement and waives monthly service. Account Fees · Monthly Service Fee — $0 or $25 · ATM Fees at Chase ATMs — $0 · ATM Fees at Non-Chase ATMs — $0. Otherwise a $5 Monthly Service Fee will apply. Product terms subject to change. For more information, please see a banker or go to leui.site $5 monthly service fee Footnote(Opens Overlay) or $0 with one of the following, each monthly statement period: A balance at the beginning of each day of. There is a $15 Monthly Service Fee (MSF) that we'll waive if you meet any of the below qualifying activities for each Chase Business Complete Checking® account. Chase Total Checking · $25 monthly service fee, which is waived if your Chase accounts have a combined average daily balance of at least $75, · Earns small. Chase checking is only free if you keep $1, or more in the account or you direct deposit at least $ a month into it. Otherwise they charge. Fees. The Chase Total Checking® account has a monthly service fee of $12, but you may qualify for a fee waiver. Aside from child and student accounts, Chase. Account Fees · Monthly Service Fee — $0 or $ · ATM Fees at Non-Chase ATMs — $3 to $5. There is a $25 Monthly Service Fee for Chase SapphireSM Checking OR $0 when you have an average beginning day balance of $75, or more in any combination of. Chase Total Checking. The monthly service fee for a Chase Total Checking account is $12 (which is a standard monthly maintenance fee across other banks such as. We charge $15 monthly for your account. You can waive this Monthly Service Fee when you complete qualifying activities. Waive fees. There are multiple ways. The only fee Secure Checking account holders are responsible for paying is a monthly fee of $ Other fees. Other fees may apply in certain cases: Domestic. Chase Total Checking and Secure Banking both have monthly service fees. Total Checking has a monthly fee of $12, but it can be waived with direct deposits or. Chase College Checking℠ is a good option for students looking for fee-free checking. The account has no minimum deposit requirement and waives monthly service. Checking account fees Chase Premier Plus Checking Chase Premier Plus CheckingSM has a Monthly Service Fee of $25, which can be waived when one of the. Plus Savings –. $50 minimum opening deposit. Must open a checking account this bank in order to open a savings account. No monthly maintenance fee. Webster Bank.

Average Mortgage Rate Los Angeles

We've compiled mortgage rate and origination data from California to give you an idea of where other borrowers are at. However, in Los Angeles, the most common choices are the year fixed-rate mortgage and the year fixed-rate mortgage. This is primarily because these home. The current average year fixed mortgage rate in California decreased 3 basis points from % to %. California mortgage rates today are 2 basis points. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate Rates based on a mortgage in Los Angeles, California. Rates. As of Saturday, September 14, , current interest rates in California are % for a year fixed mortgage and % for a year fixed mortgage. The. Adjustable-Rate Payment Options: Lump Sum, Line of Credit, Term, Tenure, Combination. APR Illustration: % +% Monthly MIP = % in total interest. The average California mortgage rate for a fixed-rate year mortgage is % (Zillow, Jan. ). California Jumbo Loan Rates. Homes in California tend to be. Year Fixed Mortgage Interest Rates California: The average rate for a year fixed-rate mortgage today is %, with an annual percentage rate of %. Today's mortgage rates in California are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check. We've compiled mortgage rate and origination data from California to give you an idea of where other borrowers are at. However, in Los Angeles, the most common choices are the year fixed-rate mortgage and the year fixed-rate mortgage. This is primarily because these home. The current average year fixed mortgage rate in California decreased 3 basis points from % to %. California mortgage rates today are 2 basis points. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate Rates based on a mortgage in Los Angeles, California. Rates. As of Saturday, September 14, , current interest rates in California are % for a year fixed mortgage and % for a year fixed mortgage. The. Adjustable-Rate Payment Options: Lump Sum, Line of Credit, Term, Tenure, Combination. APR Illustration: % +% Monthly MIP = % in total interest. The average California mortgage rate for a fixed-rate year mortgage is % (Zillow, Jan. ). California Jumbo Loan Rates. Homes in California tend to be. Year Fixed Mortgage Interest Rates California: The average rate for a year fixed-rate mortgage today is %, with an annual percentage rate of %. Today's mortgage rates in California are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check.

What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. According to Freddie Mac, current mortgage interest rates in California are % for a year fixed-rate mortgage, % for a year fixed-rate mortgage. That's a good deal compared to the average property tax rate of % statewide. 2. Bakersfield. Located about two hours north of Los Angeles, Bakersfield is. The average year fixed-rate mortgage loan in California currently has an interest rate of about %. The interest rates for year loans are slightly. Current rates in Los Angeles, California are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year ARM. Data provided by 3rd. The mortgage rates in California are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of September Los Angeles mortgage rate trends · September 05, · % · % · % · Mortgage tools · Mortgage tips · Mortgage Rates by State. September mortgage rates currently average % for year fixed loans and % for year fixed loans. · Mortgage Purchase rates in Charlotte, NC · Current. Los Angeles and Orange Counties = $1,,; Riverside and San Bernardino CMT Index: Weekly average of the one-year or five-year Constant Maturity. Compare California mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Currently, the average mortgage rates in sunny California are % for Los Angeles mortgage rate trends. September 05, year fixed. %. Our Closing Costs Study assumed a year fixed-rate mortgage with a 20% down payment on each county's median home value. Los Angeles, home of. YearARM Mortgage Rate ; Oct, ; Nov, ; Dec, ; Jan, Year Fixed Mortgage Interest Rates California: The average rate for a year fixed-rate mortgage today is %, with an annual percentage rate of %. In , the average monthly mortgage payment in California was $3,; in , it was $3,; and in , the average mortgage payment was $2, . Los Angeles Metro Average2 % APR* 30 Yr Fixed* · What Type of Home Loan is Right for You? · Fixed or Adjustable Rate · Low Down Payment Programs · Fixed or. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Sample Annual Percentage Rates (APRs): CalHFA First Mortgage Loans ; 30 yr ( months), 30 yr ( months), 30 yr ( months) ; $1,, $1,, $1, In , the average monthly mortgage payment in California was $3,; in , it was $3,; and in , the average mortgage payment was $2, .

Iras Income Tax Bracket

From onward, Singapore will increase the headline personal income tax rate to 24 percent. Chargeable income between S$, (US$,) to S$1 million . Your qualified distributions from a traditional IRA are taxable at ordinary income rates. Roth IRA: You contribute after tax money into your Roth IRA. Your. Tax implications Your employment income is taxed at 15% or progressive resident rates, whichever results in a higher tax amount. Director's fees and other. Personal Income Tax Rates. The Singapore income tax rate is progressive, relative to an individual's amount of income, ranging from 0 to 22%. Singaporeans whose. an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that has been converted to a Roth IRA;; the redemption of U.S. Income tax rate. All companies are taxed at a flat rate of 17% on both Singapore-sourced income and foreign-sourced income received in Singapore (unless. If you are a resident in Singapore, the rates of tax chargeable are as follows: 70, Chargeable Income, Rate, Gross Tax Payable. 72, $, (%), $. 73, On the. Must all distributions from IRAs be reported for PA personal income tax purposes? Yes. All IRA distributions should be reported on. PA Schedule W-2S, Wage. If you are a resident in Singapore, the rates of tax chargeable are as follows: 70, Chargeable Income, Rate, Gross Tax Payable. 72, $, (%), $. 73, On the. From onward, Singapore will increase the headline personal income tax rate to 24 percent. Chargeable income between S$, (US$,) to S$1 million . Your qualified distributions from a traditional IRA are taxable at ordinary income rates. Roth IRA: You contribute after tax money into your Roth IRA. Your. Tax implications Your employment income is taxed at 15% or progressive resident rates, whichever results in a higher tax amount. Director's fees and other. Personal Income Tax Rates. The Singapore income tax rate is progressive, relative to an individual's amount of income, ranging from 0 to 22%. Singaporeans whose. an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that has been converted to a Roth IRA;; the redemption of U.S. Income tax rate. All companies are taxed at a flat rate of 17% on both Singapore-sourced income and foreign-sourced income received in Singapore (unless. If you are a resident in Singapore, the rates of tax chargeable are as follows: 70, Chargeable Income, Rate, Gross Tax Payable. 72, $, (%), $. 73, On the. Must all distributions from IRAs be reported for PA personal income tax purposes? Yes. All IRA distributions should be reported on. PA Schedule W-2S, Wage. If you are a resident in Singapore, the rates of tax chargeable are as follows: 70, Chargeable Income, Rate, Gross Tax Payable. 72, $, (%), $. 73, On the.

Singapore income tax rates for year of assessment ; 20, to 30, · 2% · 30, to 40, · %.

Generally, foreign dividends would be taxable at the prevailing corporate income tax rate in Singapore upon remittance/deemed remittance into Singapore. Foreign. This may reduce your taxable income for the year in which you've contributed to your IRA, therefore reducing the amount of tax you pay that year. When you start. Singapore imposes corporate income tax (CIT) at a flat rate of 17 percent, which is the lowest among ASEAN member states. Singapore Personal Income Tax Calculator ; Your Tax Payable is $ on first $40, + 7% on next $40, Tax Payable on Chargeable Income. Less: Parenthood Tax. General Corporate Income Tax Rules. Corporate Income Tax is assessed on a preceding year basis in Singapore. Singapore's Corporate Income Tax rate is 17%. and visit Do I need to report the transfer or rollover of an IRA or retirement plan on my tax return? There are certain exceptions to this 10% additional. Tax residents in Singapore are taxed on a progressive rate from 0% to 24%. Filing of personal income tax returns is mandatory if their annual income is SG. Chargeable income in excess of $, up to $1 million will be taxed at 23%, while that in excess of $1 million will be taxed at 24%; both up from the current. federal taxable income and may push a client into a higher tax bracket. tax rate would make an investor indifferent to a Roth IRA conversion. Open PDF. a Traditional IRA using an average income tax of 25% and 5% rate of re- turn for each account. When the tax rates and the rates of return are identical, would. Also, Delaware has a graduated tax rate ranging from % to % for income under $60,, and % for income of $60, or over. As a result, there is no. Will IRA withdrawals be tax-free? How about Social Security benefits? When do you owe at the federal ordinary income tax rate, and what qualifies for the. Singapore. Income Tax Rate. 0% - 20%. Corporate Tax Rate. 17%. Sales Tax / Service Rate. 7%. Personal Income Tax. Income occurred and received in Singapore. However, if you withdraw money before you reach age 59½, you will be assessed a 10% penalty in addition to the regular income tax based on your tax bracket. This may reduce your taxable income for the year in which you've contributed to your IRA, therefore reducing the amount of tax you pay that year. When you start. The effective tax rate is the California tax on all income as if you were a income, which includes IRAs. Accordingly, you will be allowed a basis. tax rate schedule to chargeable income as follows. Income tax rate table from the YA to YA , in Singapore dollars (SGD). Chargeable Income. Income. Chargeable income from S$, up to S$1 million will be taxable at a rate of 23%; income in excess of S$1 million will be subject to a tax rate of 24%. Non-. Singapore's personal tax rates start at 0% and are capped at 22% (according to Year of Assessment ) for Singapore residents and a flat rate of 15% to.